Allow Cookies ?

To enhance your browsing experience on our website, we utilize cookies. For more detailed information regarding our use of cookies, kindly refer to our privacy policy.

Happy Customers

CA & Lawyers

Offices

Tax professionals handle the complexities of the Indian tax structure by providing services in Corporate Tax, Transaction Services, and Tax Return Filing. The focus is on simplifying the intricate landscape to ensure compliance and effective tax management for businesses.

Tax professionals also manage indirect taxes, including service tax, excise duty, customs duty, VAT, CST, SVB, and GST, which presents a diverse and state-specific challenge. They bring their expertise to handle these complexities, ensuring businesses meet their indirect tax obligations seamlessly.

Planning.png)

In the era of GST as a transformative reform, companies need strategic planning for transition, impact analysis, understanding of taxability, and compliance. So, taxation services assist businesses in adapting to the changing GST landscape.

Experts in taxation services help businesses explore options for international expansion while navigating the complexities of diverse tax regulations.

As the number of MNCs grows in India, the demand for specialized skills from 'expatriates' has risen. Debuting ex-pats in India involves meeting statutory obligations, such as VISA documentation, bank account opening, obtaining PAN, FRRO compliance, and filing Income Tax returns. These proficiencies are offered by top Outsourced CFO Services providers in India.

Tax professionals handle transfer pricing management, which covers documentation, risk assessment, planning, consulting, and handling transfer pricing controversies. This ensures businesses manage transfer pricing intricacies effectively.

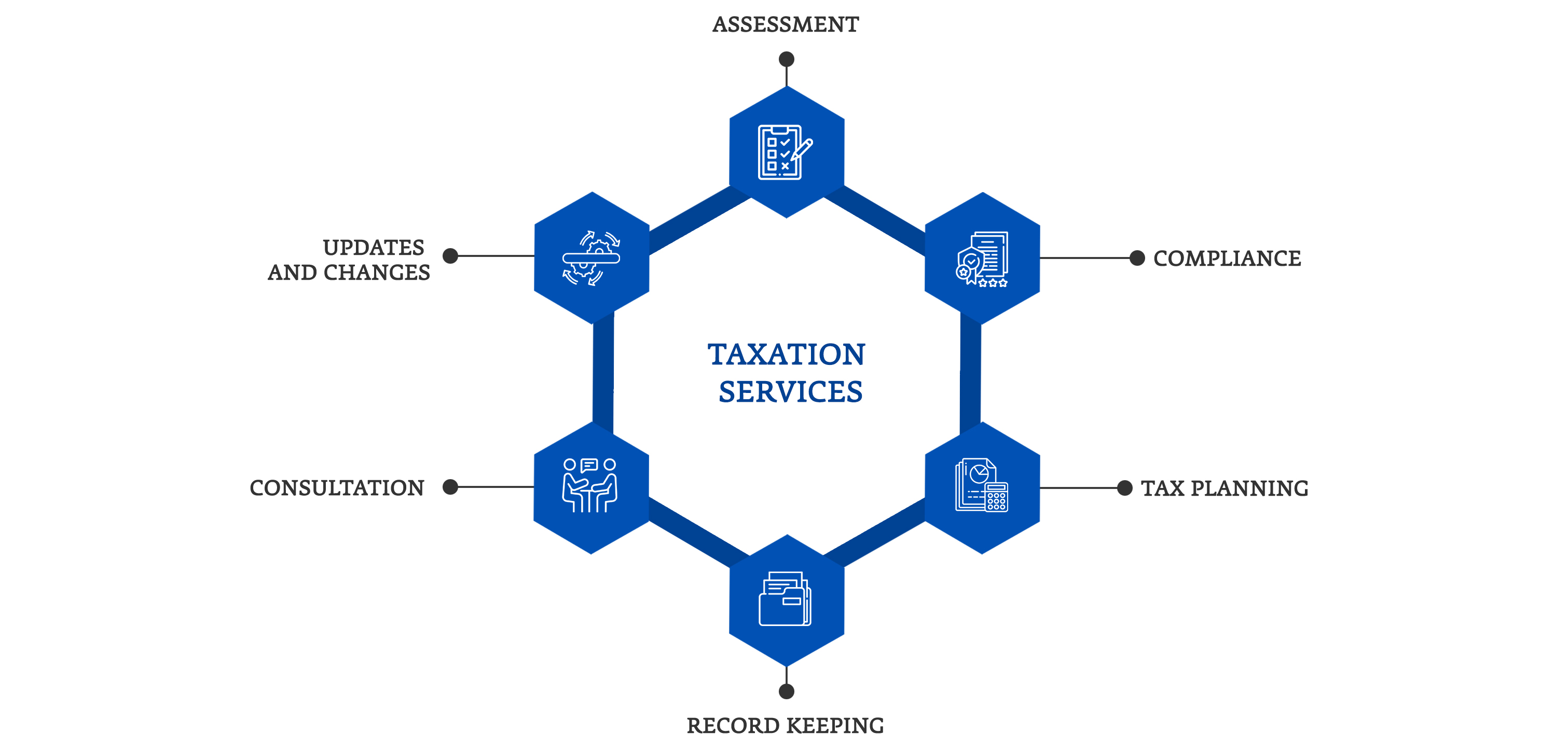

Taxation professionals assess the business's financial situation, including income, expenses, assets, and liabilities.

They ensure that the business complies with all relevant tax laws and regulations, filing necessary tax returns accurately and on time.

Taxation services help businesses plan ahead to minimize their tax liabilities legally. This may involve identifying tax deductions, credits, and incentives that the business qualifies for.

They assist in maintaining proper records of financial transactions, which is crucial for accurate tax reporting and compliance.

Taxation professionals provide guidance and advice on tax-related matters, such as business structure, investment decisions, and major financial transactions.

Taxation services keep businesses informed about changes in tax laws and regulations that may affect their operations, ensuring continued compliance.

Restructuring existing entity shareholding to achieve tax and regulatory efficiency. The restructuring will eventually maximize the value of Promoters/Investors. We also provide advice on tax and regulatory efficient acquisition of Target. The advice will cover deal advisory, structuring, valuation and implementation. We also advise on cross border investment strategies. The advisory will cover compliance with corporate and foreign exchange laws. We also provide Promoter value enhancement strategies in a tax efficient manner in case of Pre-IPO situations to consolidate value of the business and the Promoters. Additionally we provide Exit strategy for investors and Promoters,Acquiring stressed assets directly or through insolvency process,Strategizing succession planning and implementation,Transaction tax and regulatory due diligence

Download The Brochure

Taxation services are tailored to meet the needs of various sizes of businesses, offering comprehensive support and guidance in navigating the complexities of tax regulations and compliance requirements.

Taxation services are tailored to meet the needs of various sizes of businesses, offering comprehensive support and guidance in navigating the complexities of tax regulations and compliance requirements.

It is imperative for business owners, whether they operate as sole proprietors, partners, or corporations, to enlist the services of a tax professional to comprehend and meet their business tax responsibilities. Seeking help from a tax professional will guarantee that tax returns are precise and accurate. Additionally, they will help businesses discover all the deductions and credits they qualify for.

Startup founders and entrepreneurs face distinctive challenges in the realm of business taxation. Taxation services offer guidance on navigating specific tax incentives, credits, and challenges associated with entrepreneurial ventures, ensuring compliance and maximizing financial efficiency.

Companies operating internationally face complex tax landscapes involving cross-border transactions, transfer pricing, and foreign tax regulations. Taxation services with expertise in international taxation help navigate these complexities while ensuring compliance with local and international laws.

Different industries have specific tax implications and regulations. Taxation services tailored to particular sectors, such as manufacturing, technology, or healthcare, can provide insights and strategies customized to the industry's needs.

With intricate financial structures and global operations, large corporations face unique tax challenges. Tax professionals provide specialized guidance to manage tax risks, maximize deductions, and enhance overall tax efficiency.

E-commerce businesses may have sales tax obligations in multiple jurisdictions, as well as unique tax considerations for digital products and services. Taxation experts can assist them in understanding and complying with these requirements.

Access highly experienced talent in one place.

Hire CFOs on-demand and on a plug-and-play basis.

Get end-to-end support for all your tax-related needs.

Add value to your business at a fraction of the cost of a full-time finance team.

Choose from a comprehensive list of virtual CFO solutions with on-site, off-site, and hybrid options.

Still unsure about onboarding a virtual CFO? Hear it from our esteemed clients

Use this free tool to check your financial preparedness in under 2 minutes.

Take the Assessment

Virtual CFO services help SME manufacturing companies and startups improve strategic financial planning and implementation at a fractional cost.

Are you looking for a temporary interim CFO to manage financial challenges? CFO Bridge offers on-demand interim CFOs with strategic and operational solutions.

Are you considering bringing on outsourced CFO services or fractional CFO services but not quite sure of their potential value to your mid-sized business? An outsourced CFO/ a fractional CFO offers high-level financial strategy and practical implementat

Did you know that many new companies don't make it past their first few years? In India, about 9 out of 10 startups face this tough reality. Scaling operations efficiently is often the most challenging hurdle for young startup companies. Startups need t

Taxation services involve handling various aspects of taxes for businesses to comply with tax regulations. This includes tasks like strategic tax planning and addressing specific tax-related needs to simplify the overall tax process.

Expertise: Navigate complex tax laws and maximize deductions & credits.

Accuracy: Minimize errors and penalties with professional preparation.

Time-saving: Focus on your priorities while experts handle the paperwork.

Peace of mind: Enjoy stress-free tax season, knowing things are done right.

Compliance: Stay informed and compliant with ever-changing regulations.

Audit support: Get expert guidance and representation if needed.

Optimization: Strategize for future tax savings and financial goals.

Tax return preparation & filing

Tax planning & optimization

Business tax services

Financial planning & consulting

Ongoing support & guidance

Look for a taxation professional with a relevant degree or certification.

Ensure they have experience in handling tax matters similar to your needs.

Check for memberships in professional associations related to taxation.

Verify their understanding of current tax laws and regulations.

Seek someone with good communication skills to explain complex tax matters clearly.

Consider their reputation and client reviews for reliability and trustworthiness.

Evaluate their technology proficiency for efficient use of tax software and tools.

Confirm their commitment to ongoing professional development in the field.

The cost of taxation services can vary based on factors like the complexity of your business and the specific services you need. It's best to contact a tax professional or firm directly to get a personalized quote tailored to your situation.

No, a fractional tax expert will guide and work with your account for tax planning and compliance. They will not replace your in-house accountant.

Ensure the professional has relevant qualifications and is well-versed in tax laws.

Choose someone with experience in handling taxes for businesses similar to yours.

Look for feedback from other businesses or clients to gauge their reputation.

Clearly understand their pricing structure and ensure it aligns with your budget.

Opt for someone who is accessible and responds promptly to your inquiries.

Consider if the professional specializes in the specific tax needs of your industry.

Choose someone with good communication skills to ensure clarity in discussions.

If you feel comfortable and confident in their abilities, it's a positive sign.

Yes, taxation services are confidential. Using such services protects your financial information, ensures privacy, and adheres to professional standards.

Potential exposure to inaccurate filing.

Risk of data breaches and identity theft.

Possibility of overlooking eligible deductions.

Dependence on software reliability for calculations.

Late filing penalties and interest charges.

Need for understanding complex tax laws.

Vulnerability to fraudulent schemes or scams.

Importance of choosing reputable taxation services.

Let's talk! Book your free consultation today