Allow Cookies ?

To enhance your browsing experience on our website, we utilize cookies. For more detailed information regarding our use of cookies, kindly refer to our privacy policy.

Happy Customers

CA & Lawyers

Offices

In rapid acquisitions, an Interim CFO serves as an integrator or program manager, facilitating efficient integration of the acquired entity.

Interim CFOs offer coaching and mentoring to new CFOs, ensuring a seamless transition into their role or serving as temporary CFOs based on your needs.

Interim CFO Services can help drive key projects for the CFO office. Once the special one-time project is over, the services of the CFO are not required. So, hiring an in-house permanent CFO does not make sense. Bringing in an Interim CFO saves internal leaders the trouble of searching for a new role for an in-house employee once the project ends.

When acquiring a business, an Interim CFO bridges the gap until your chosen CFO is available, ensuring a smooth transition from day one.

Interim CFO Services help guide your business through uncertainties like CFO resignations, delayed new hires, or extended leaves, providing stability during transitions.

If you are launching a new division, an Interim CFO can assist with crucial tasks like crafting a business plan and setting up efficient systems for a smooth transition.

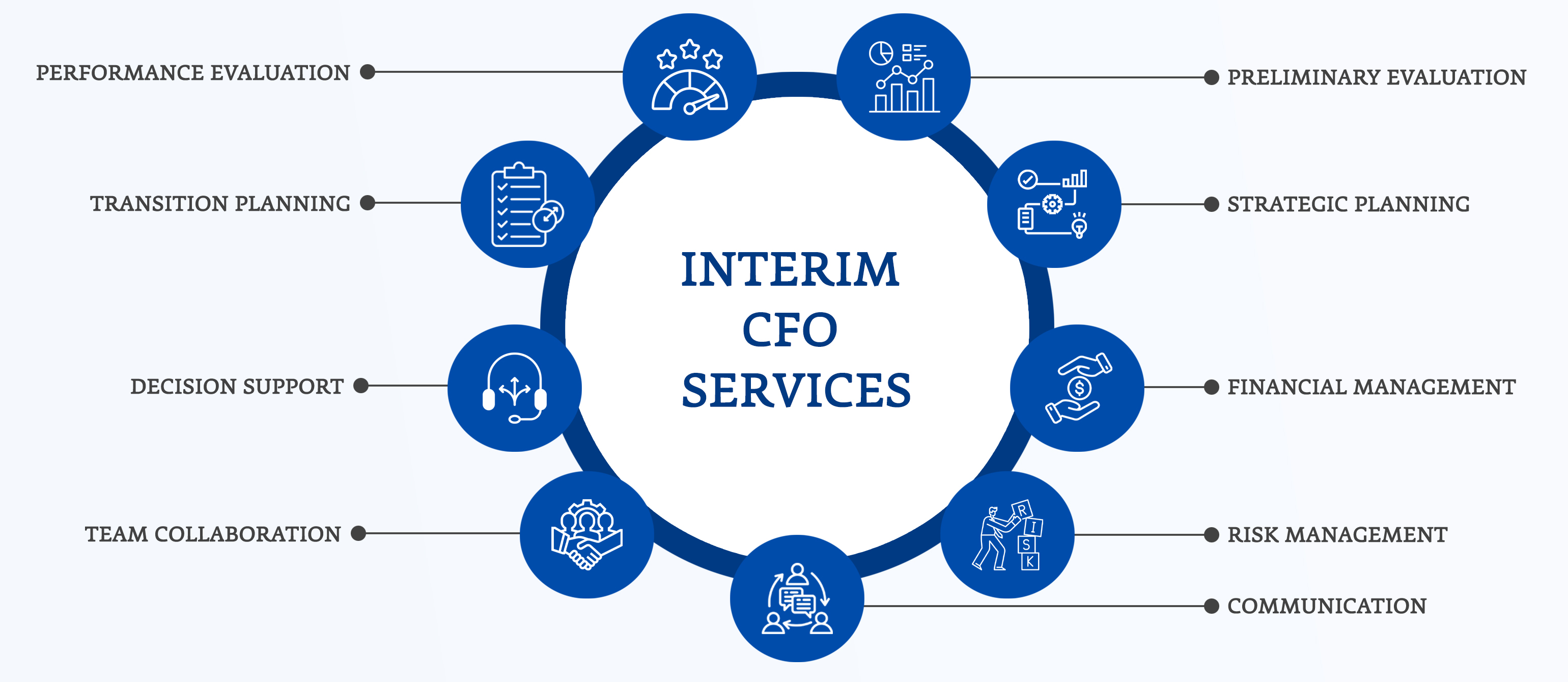

Conduct a thorough assessment of the client company's financial situation, goals, and challenges. Understand the specific needs and areas requiring financial expertise.

Develop a short-term financial strategy aligned with the company's overall goals. Identify key financial objectives and milestones to be achieved during the interim period.

Oversee day-to-day financial operations, ensuring adherence to best practices and regulatory compliance. Implement efficient financial processes to enhance overall financial management.

Evaluate potential financial risks and formulate strategies to mitigate them. Provide recommendations for risk reduction and financial stability.

Maintain open and transparent communication with the client company's leadership. Present regular reports and updates on financial performance and key metrics.

Collaborate with existing finance teams, offering guidance and support. Offer training or resources to enhance the internal team's financial capabilities.

Provide financial insights to support the company's executives' decision-making and make data-driven recommendations for improving financial outcomes.

Develop a transition plan for the handover to a permanent CFO to ensure a smooth transfer of knowledge and responsibilities.

Establish key performance indicators (KPIs) to measure the success of the interim CFO services. Conduct regular evaluations and adjustments to ensure continuous improvement.

Helping you navigate your business through transition periods with experienced CFOs.

Download The Brochure

Get expert financial guidance during the business transformation from our Interim CFO Services. Our experienced professionals offer short-term financial strategy and business skills to help.

along with permanent and temporary cfo services to help navigate through financial crises, operational changes, or CFO transitions. So, focus on scaling up while we handle profitability, cash flow, and key performance indicators.

When businesses encounter resource shortages, the demand for Interim CFO services becomes evident. During such pivotal moments, companies seek financial expertise and support to navigate challenges effectively. Interim CFOs from Virtual CFO Services providers ensure that businesses receive the necessary financial guidance without overburdening their resources, allowing them to address critical needs efficiently.

Private equity firms require Interim CFO services to access expert financial leadership for their portfolio companies. These interim CFOs offer crucial support during pivotal transitions, including driving turnarounds and streamlining pre-sale activities, providing the flexibility and expertise necessary for success in dynamic business environments.

Implementing a significant system change, like an ERP, is tough for many organizations. An interim CFO can help improve how an organization handles the change by advising on resource allocation, training, and communication. They also assist in planning and coordinating the effort, ensuring the organization stays healthy during significant changes.

Mergers and exits require careful financial planning. Interim CFOs specialize in guiding companies through these complex processes. They provide strategic financial insights and help companies navigate negotiations, due diligence, and other financial aspects involved in mergers or exits.

Interim CFOs can be a game-changer for start-ups and small businesses looking to scale and achieve their growth. They play a crucial role in financial planning, developing strong strategies, and presenting financial information in a compelling manner to attract potential investors. Virtual CFO Services providers guide them through the complexities of financial management, aiding them in making informed decisions that align with their growth goals.

As organizations expand, they often have to make quick decisions. However, it’s crucial to consider the full impact of these decisions to stay ahead in the market. Bringing in an Interim CFO can give you the expertise necessary to make fast and trustworthy decisions supported by up-to-date financial information.

Add value to your business at a fraction of the cost of a full-time CFO

Experienced interim CFOs with wide industry knowledge and connections

CFO Bridge’s Interim CFOs are available whenever you require for a specific period

Get access to CFO Bridge’s 30+ CFO partners, 30+ CAs & network of all relevant service providers

Interim CFO Services can be availed for a short period of 3 months to up to 1 year

Still unsure about onboarding a virtual CFO? Hear it from our esteemed clients

Use this free tool to check your financial preparedness in under 2 minutes.

Take the Assessment

Virtual CFO services help SME manufacturing companies and startups improve strategic financial planning and implementation at a fractional cost.

Are you looking for a temporary interim CFO to manage financial challenges? CFO Bridge offers on-demand interim CFOs with strategic and operational solutions.

Are you considering bringing on outsourced CFO services or fractional CFO services but not quite sure of their potential value to your mid-sized business? An outsourced CFO/ a fractional CFO offers high-level financial strategy and practical implementat

Did you know that many new companies don't make it past their first few years? In India, about 9 out of 10 startups face this tough reality. Scaling operations efficiently is often the most challenging hurdle for young startup companies. Startups need t

Interim CFO services involve hiring a temporary Chief Financial Officer (CFO) to address a company's financial needs. This professional assesses financial situations, creates short-term strategies, manages day-to-day financial operations, and supports decision-making until a permanent CFO is in place.

Immediate Expertise:

Interim CFOs bring specialized skills and experience, providing immediate financial guidance and support to businesses.

Flexibility:

Organizations can engage interim CFO services for a specific project or during a transitional period, allowing flexibility in addressing financial needs.

Objectivity:

Interim CFOs, being external to the organization, can bring an unbiased perspective and identify areas for improvement without internal biases.

Strategic Focus:

Interim CFOs often focus on strategic financial planning, helping organizations set and achieve financial goals during their tenure.

Knowledge Transfer:

Interim CFOs can transfer knowledge and best practices to existing finance teams, enhancing the organization's overall financial capabilities.

Crisis Management:

They can step in during financial crises or leadership gaps, providing stability and helping navigate challenging situations.

Strategic Financial Advice

Mergers and Acquisitions

Financial Strategy

Budgeting and Forecasting

Cash Flow Management

Risk Management

Cost Control and Management

Financial Reporting

Stakeholder Communication

Start with a meeting to understand the company's needs and challenges.

The Interim CFO provides a proposal outlining services and terms, leading to an agreement if accepted.

Gather necessary information, access to systems, and introduction to the team.

Identify key financial areas requiring attention and develop an action plan.

Execute the plan, address financial issues, improve processes, and provide guidance.

Maintain open communication with the company, providing progress reports and addressing concerns.

A proven track record in financial leadership roles.

Relevant degrees in finance, accounting, or a related field.

Familiarity with your industry and understanding of its unique challenges.

Communicate financial insights clearly to non-experts.

Check references to validate their previous successful interim roles.

The cost of Interim CFO services can vary based on factors like the scope of work, the duration of service, and the expertise required. It's advisable to discuss specific needs with the service provider for a tailored and transparent pricing structure.

No, an Interim CFO typically does not replace an accountant. While an Interim CFO focuses on high-level financial strategy and management, accountants handle day-to-day financial tasks, ensuring accurate record-keeping and compliance. Both roles complement each other to support comprehensive financial management.

Look for an Interim CFO with relevant experience in your industry or similar businesses.

Ensure their skills align with your specific financial needs and challenges.

Check references and reviews to gauge their past performance and reliability.

Consider how well the Interim CFO will integrate with your company's values and work culture.

Choose someone adaptable to the temporary nature of the role and can quickly understand your business.

Opt for an Interim CFO who communicates clearly and can simplify financial concepts for your team.

Yes, Interim CFO services prioritize confidentiality. Professionals handling these services adhere to strict confidentiality agreements, safeguarding the client's financial information and sensitive data throughout the engagement.

Limited Familiarity: Interim CFOs may not be as familiar with the company's specific nuances compared to a permanent CFO.

Transition Challenges: The transition period might pose challenges in aligning with existing team dynamics and workflows.

Dependency on Briefing: Success depends on the effectiveness of the initial briefing and understanding of the company's financial landscape.

Potential Resistance: Existing staff may resist temporary leadership, affecting collaboration and morale.

Long-term Strategy: Interim CFOs may focus more on immediate financial needs rather than long-term strategic planning.

Cost Consideration: While often cost-effective, there could be unanticipated costs if the transition is not smooth or if misunderstandings arise.

Let's talk! Book your free consultation today